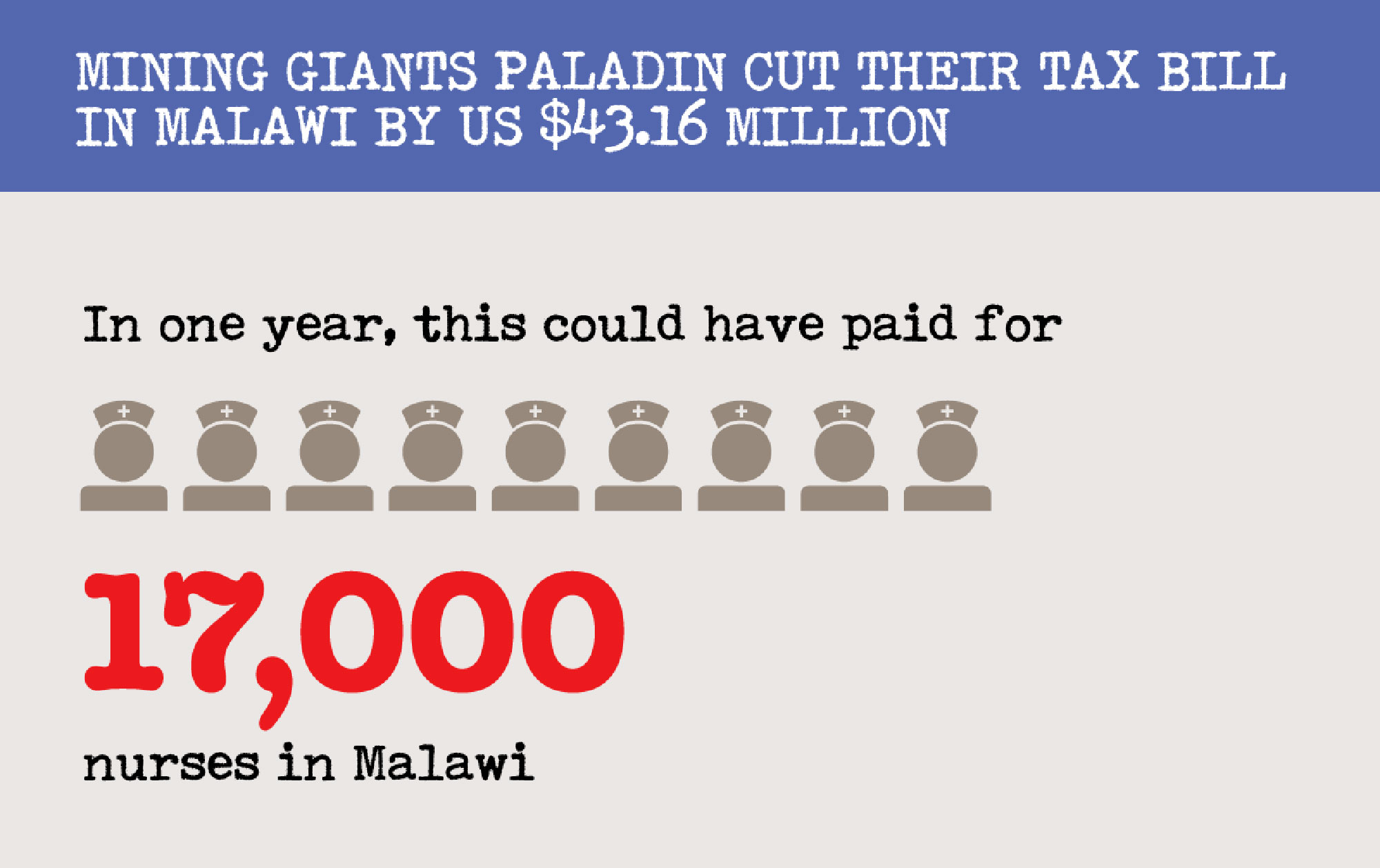

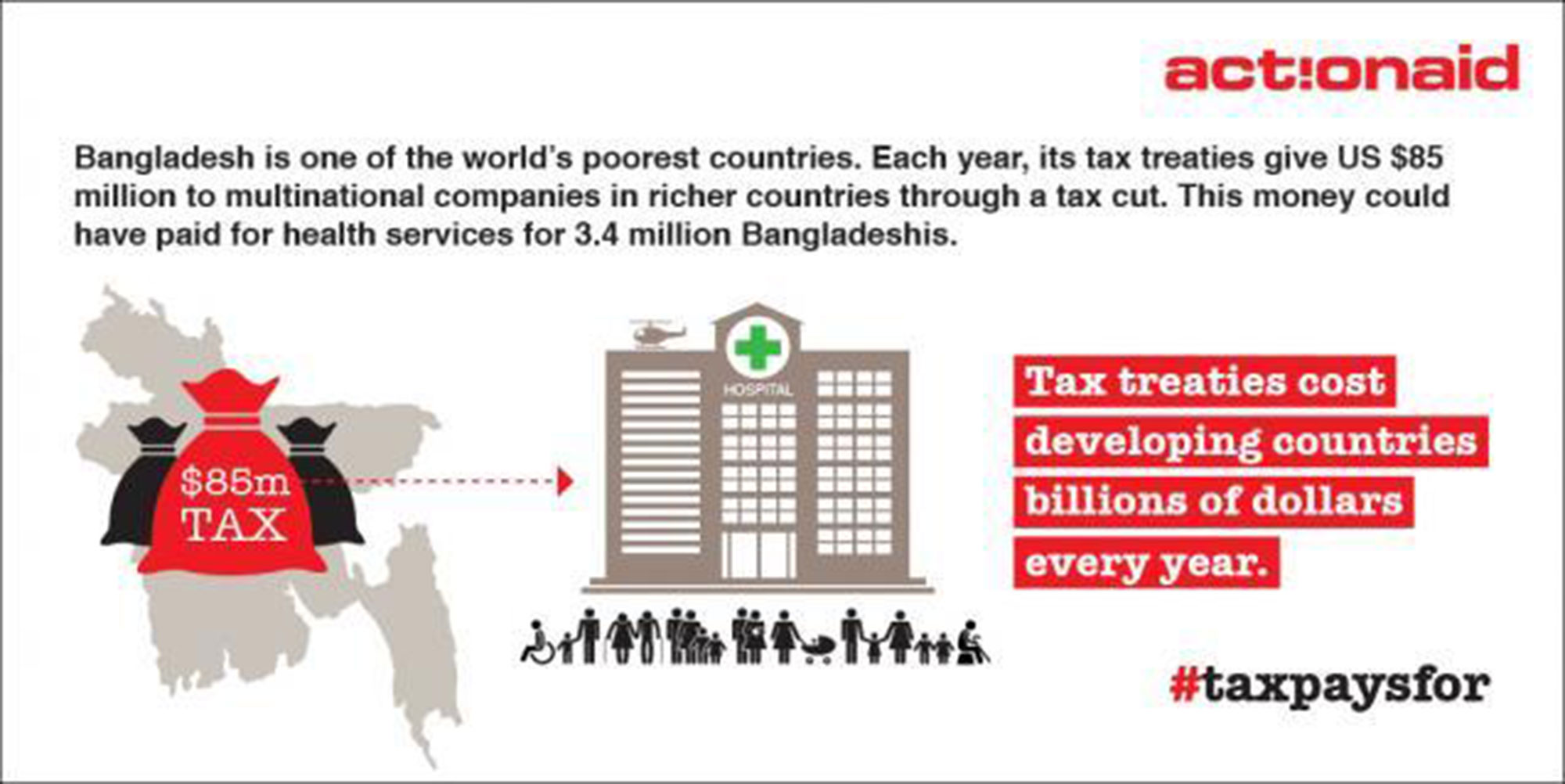

Around the world, millions of you have been shining the spotlight on dodgy tax practices of some of the world’s biggest and most profitable companies. They have been draining hundreds of billions of dollars from developing countries - funds desperately needed for vital public services that transform lives, like schools and hospitals.

ActionAid supporters used people power to demand companies clean up their act, and that governments change the scandalous and outdated tax rules that let it happen – and they’ve been winning! Here are some of the highlights of the last few years. But our work is not done. We must keep fighting for tax justice.